Ministry of Labour and Thawani Sign Cooperation Agreement to Study Mechanisms for Activating Additional Incentives for Civil Service Employees under the “Ejada” System

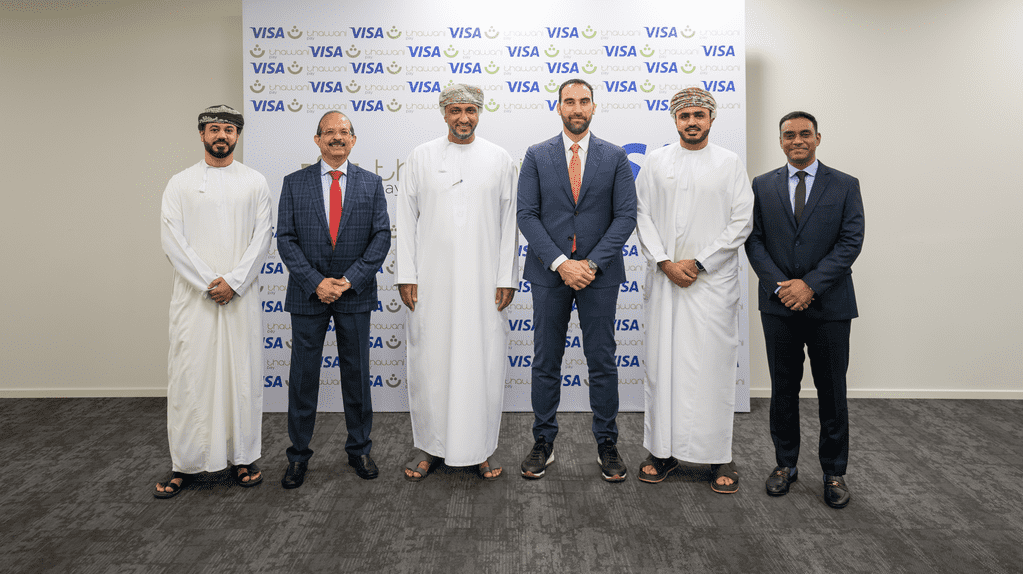

News Ministry of Labour and Thawani Sign Cooperation Agreement to Study Mechanisms for Activating Additional Incentives for Civil Service Employees under the “Ejada” System Muscat: The Ministry of Labour has signed a cooperation agreement with Thawani, a leading provider of innovative digital solutions, to study mechanisms for implementing exclusive non-monetary incentives for members of the “Ejada” performance management system. The agreement was signed during the Global COMEX Technology Exhibition 2025. This collaboration aligns with the national direction toward adopting advanced digital solutions that support Oman’s economy, enhance employee quality of life, and strengthen institutional work environments—ultimately boosting the Sultanate’s competitiveness in its pursuit of a digital economy. The agreement was signed on behalf of the Ministry of Labour by H.E. Sayyid Salem bin Musallam Al Busaidi, Undersecretary for Human Resources Development, and on behalf of Thawani by Eng. Majid bin Fayil Al Amri, Founder and CEO of Thawani. More than 210,000 government employees and their families are expected to benefit from a wide range of exclusive offers covering key sectors such as hotels and resorts, restaurants and cafés, travel and tourism, airline tickets, and other carefully designed services tailored to the needs of employees and their families.Thawani will study the most suitable mechanism for providing a secure, user-friendly digital environment, supported by real-time tracking of offers and detailed reports to measure usage and engagement. This enhances transparency and improves the efficiency of delivery service. The agreement also enables government entities to showcase their own rewards and initiatives through the platform, giving employees the freedom to select benefits based on their needs and interests, while ensuring they receive updates on new offers easily.Additionally, the agreement includes studying the impact of these incentives on improving job performance and enhancing employee satisfaction—contributing to a better work environment and the achievement of institutional goals. H.E. Sayyid Salem bin Musallam Al Busaidi affirmed that this collaboration represents an advanced partnership between the public and private sectors in delivering digital economic services that support entrepreneurship and expand the national economic base, in line with global trends toward building a more inclusive and sustainable knowledge-based digital economy. He added that the agreement reflects Oman’s commitment to adopting cutting-edge technologies that promote economic and social development, while opening wider opportunities for SMEs and entrepreneurs to reach beneficiaries—supporting self-employment and fostering innovation. For his part, Eng. Majid bin Fayil Al Amri stated that this cooperation marks an important step toward strengthening Oman’s position within the digital economy. It reflects Thawani’s vision of developing innovative solutions that serve individuals and support the national economy. He emphasized that the shift toward a digital economy is no longer optional, but a strategic pathway for enhancing sustainable growth and raising the Sultanate’s competitiveness in regional and global markets.